We have prepared the steps to check for the Income Tax Number. You need to enter your User ID Password Date of Birth or Incorporation Date and Captcha on the e-Filing website.

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

For a new taxpayer or existing taxpayer who would like to complete ITRF for the first time there are a few steps you have to complete prior to filling the ITRF form online through e-Filing.

. You can check by calling the LHDN Inland Revenue Board - please have your IC or passport number ready. Type of File Number 2 alphabets characters SG or OG space Income Tax Number maximum 11 numeric characters Example. You will receive your Income Tax Reference Number within 3 working days after completing an online.

Nombor Cukai Pendapatan yang boleh digunakan untuk melakukan semua urusan dengan LHDNM atau. For Malaysian citizens and permanent residents you can find your Income Tax Number on your tax returns. Visit the official Inland Revenue Board of Malaysia website.

How To Check Income Tax Number Malaysia. Guide for Individual Guide for Company Guide for Employer Guide for Partnership Guide for LLP. Go to My Account and.

Visit the Inland Revenue Board of Malaysias website. Application form to register an income tax reference number can be obtained from the nearest Income Tax Offices. I want you to.

E-Daftar can be reached by clicking on the icon. StashAway Malaysia Sdn Bhd 201701046385 is licensed by the Securities Commission Malaysia Licence eCMSLA03522018. If you do not hold but require an Income Tax Number you should.

In step 3 you will need to choose your preferred search criteria BVN NIN or R. If you were previously employed you may already have a tax number. The CP38 notification is issued to the employer as supplementary instructions to clear the balance of tax liability of employees over and above the Monthly Tax Deductions MTD 30th June 2022 is the final date for submission of Form B Year Assessment 2021 and the payment of income tax for individuals who earn business income.

Unique 12-digit number issued to Malaysian citizens and permanent residents and is used by the IRBM to identify its taxpayers. Disposal Date And Acquisition Date. LHDN has prepared these guides to help you register for your income tax number via e-Daftar.

This Income Tax Office info page is to provide information such as address telephone no fax no office hours and etc. Real Property Gains Tax RPGT Rates. The Semak Number which can be found on your income tax return will tell you whether or not you have an Income Tax Number.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year Personal Tax Relief 2021. A copy 1 appointment letter as a tax agent if the registration is done by a tax agent. Starting from January 2021 all Malaysians above the age of 18 and corporate entities will be assigned a Tax Identification Number TIN said Deputy Finance Minister Datuk Amiruddin Hamzah in his address at the Malaysia Tax Policy forum.

Get to the Joint Tax Boards verification portal for step 1. The Semak Number which can be found on your income tax return will tell. I need these details to fill in the application form thanks a lot.

Click on ezHASiL. The Type of File Number and the Income Tax Number. Special Income Remittance Program PKPP For Malaysian Tax Resident With.

A copy 1 an acknowledgement letter from Malaysia Institute of Accountants MIA if relevant and 9. Click ezHASiL to get your Income Tax Number. SG 10234567090 or OG 25845632021 For individual ITN the end number can be either 0 or 1 which indicates the husband or wife.

Disposal Price And Acquisition Price. How Can I Check My Income Tax Status Online Malaysia. Determination Of Chargeable Gain Allowable Loss.

03-8911 1000 Local number 03-8911 1100 Overseas number. Introduction And Basis Of Taxation. SEMAKAN NO CUKAI PENDAPATANSYARIKAT MALAYSIACara Check Income Tax Number Online Sekiranya anda pembayar cukai sama ada individu atau syarikat yang telah berdaftar semestinya anda mempunyai nombor cukai pendapatan Malaysia.

When can you get your Income Tax Reference Number. It has about 100 branches including UTC nationwide. Call 03-8911 1000 local or 03-8911 1100 overseas.

The numbers are 03-8911 1000 local and 03. On the Income Tax Return ITR Status page enter your acknowledgement number as well as a. The LHDN Inland Revenue Board can assist you with this be sure to have your ID or passport number handy.

Section II TIN Structures 1 ITN The ITN consist of maximum twelve or thirteen alphanumeric character with a combination of the Type of File Number and the Income Tax Number. Register Online Through e-Daftar. E-Daftar can be accessed by clicking on it.

Please carefully read the instructions. Example for Individual File Number. IRBM Stamp Duty Counter Operating Hours.

To check the status of an Income Tax Return ITR click the Income Tax Return Status button. The following is a list of Income Tax Office sorted by states. Click on e-Daftar.

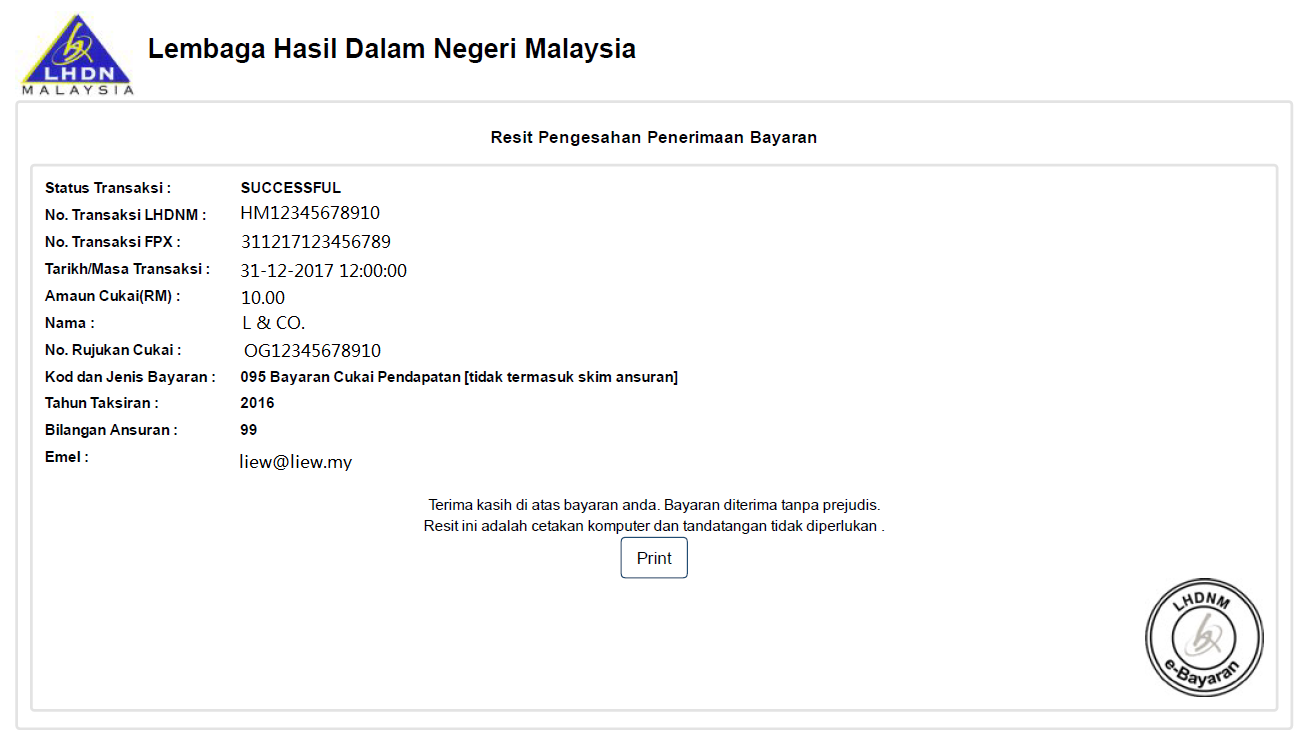

Once you know your income tax number you can pay your taxes online. Click on the borang pendaftaran online link. Also LHDN extended the dateline for extra 2 weeks.

The second step is to pick your birth date. On the Income Tax Office for the conveniences of general public. The most important thing is you will get a faster refund in case you paid excess income tax through PCB.

Dear all I am seeking for your kind help by guiding me how to know my income tax number and socso number. By clicking the link you will be taken to the online registration page. In step four youll enter the number of the search criteria you selected.

IRBM Revenue Service Centre Operating Hours. Go through the instructions carefully. Click on the e-Daftar icon or link.

Company Tax Deduction 2021. Call the LHDN Inland Revenue Board and be prepared to give them your IC or passport number. How To Check Income Tax File Number Malaysia.

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Income Tax Guide 2022 Ya 2021

How To Pay Your Income Tax In Malaysia

.png)

How To Check Your Income Tax Number

Payment Method For Personal Income Tax Bona Trust Corporation 博纳信托有限公司

10 Things To Know For Filing Income Tax In 2019 Mypf My

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

7 Tips To File Malaysian Income Tax For Beginners

7 Tips To File Malaysian Income Tax For Beginners

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

How To Check Your Income Tax Number

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

Individual Income Tax In Malaysia For Expatriates

Tips For Income Tax Saving L Co Chartered Accountants

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

7 Tips To File Malaysian Income Tax For Beginners

The Complete Income Tax Guide 2022